It’s June 1982. Gold is traded at $350 per ounce after an impressive rally of the 70’s, S&P500 is at 110 points and 10-yeat bond yields are at 14%. Oh, and inflation is at 7%, highest in 4 months but down from 14.8% in March 1980. This was the last period of high inflation in the US. It attempted to break higher in early 90’s and 2008 but never was a real threat again. Until today.

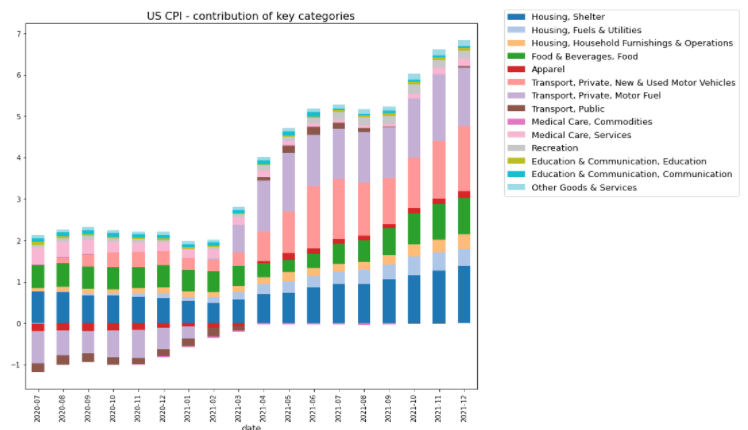

Inflation in the US is highest in 40 years. Will that be a problem for markets in 2022? Source: Macrobond, XTB Research

When inflation jumped above 4% in April 2021 the Fed called it transitory and chose not to act. It was thought as a one-off process caused by year-to-year changes in fuel prices (after all oil prices flirted with 0 in April 2020). This approach proved to be irresponsible. The US economy was already booming, fueled by fiscal transfers and post-pandemic re-opening. Even if the fire was lit by oil prices, it quickly spilled over to other categories. Cars (new and used), equipment, furniture all these things because costlier as a combination of demand boom and difficulties on the supply side caused by COVID restrictions around the World. Today inflation is at 7% and the Fed needs to act. This indeed will be the case. As recently as November the Fed did not want to discuss interest rate hikes. Today it not only communicates them but also hints at a balance sheet reduction, a tool (think of reverse money printing) that was last used in 2018, contributed to slowdown and caused market turbulences.

All major categories are contributing to inflation. This is a problem for the Fed. Source: Macrobond, XTB Research

All major categories are contributing to inflation. This is a problem for the Fed. Source: Macrobond, XTB Research

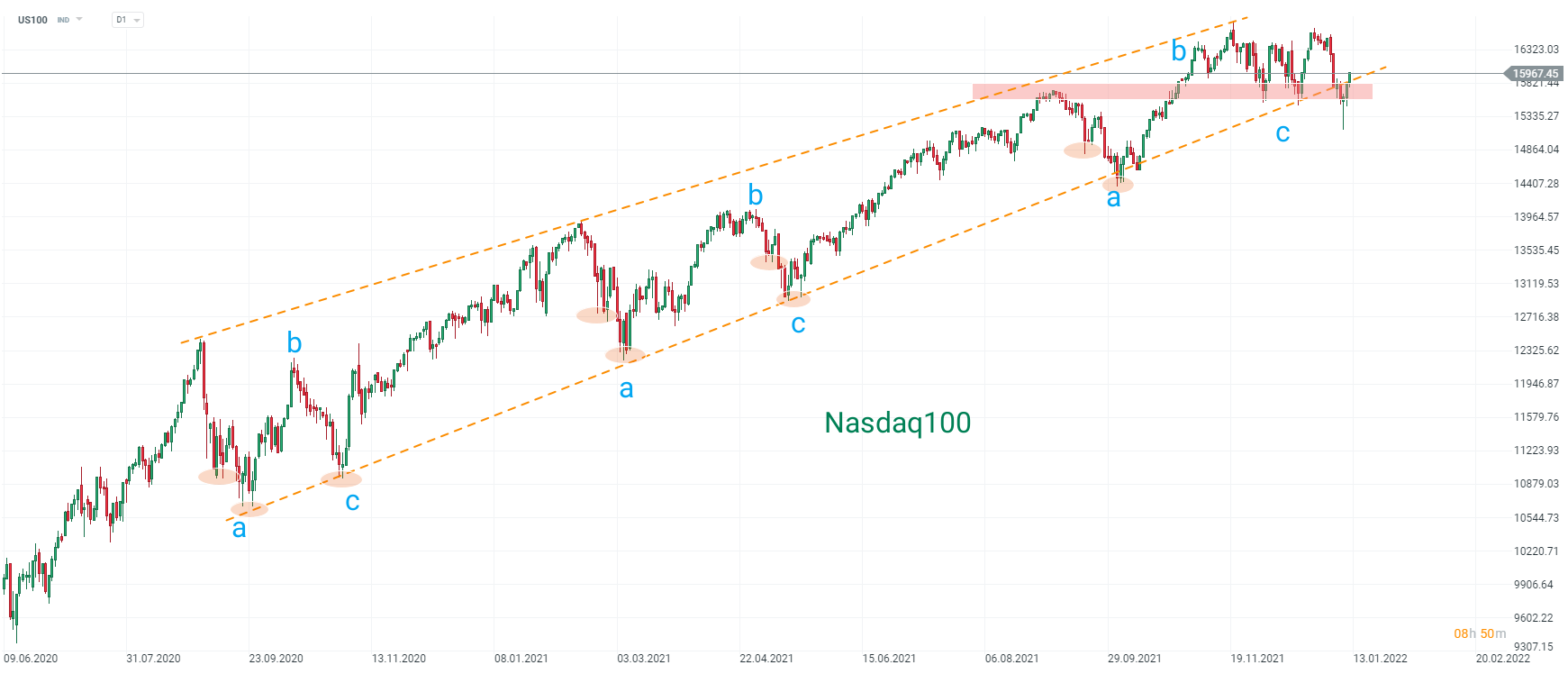

Speaking of market, investors remain sanguine for now. Recall that in 1982 10-year bond yields were at 14%, now they are nearly 10-times lower! Yes the Fed speaks about rate hikes and balance sheet reduction but as of today they are still printing (even if this is about to end soon) and rates are at the lower bound. The party lasts, but for how long?

US100 is the market that is the most sensitive to Fed policies. There was a scare on Monday but the index is rallying again. Source: XTB platform

US100 is the market that is the most sensitive to Fed policies. There was a scare on Monday but the index is rallying again. Source: XTB platform