- Indices open higher

- Bond yields gain

- Dollar also slightly positive

On the last day of this week, equity market indices continue to rise, gaining about 0.15-0.30% at the time of publication. We observe a slight rebound in US bond yields after recent declines. The dollar, however, does not follow a clear direction and remains around the opening levels.

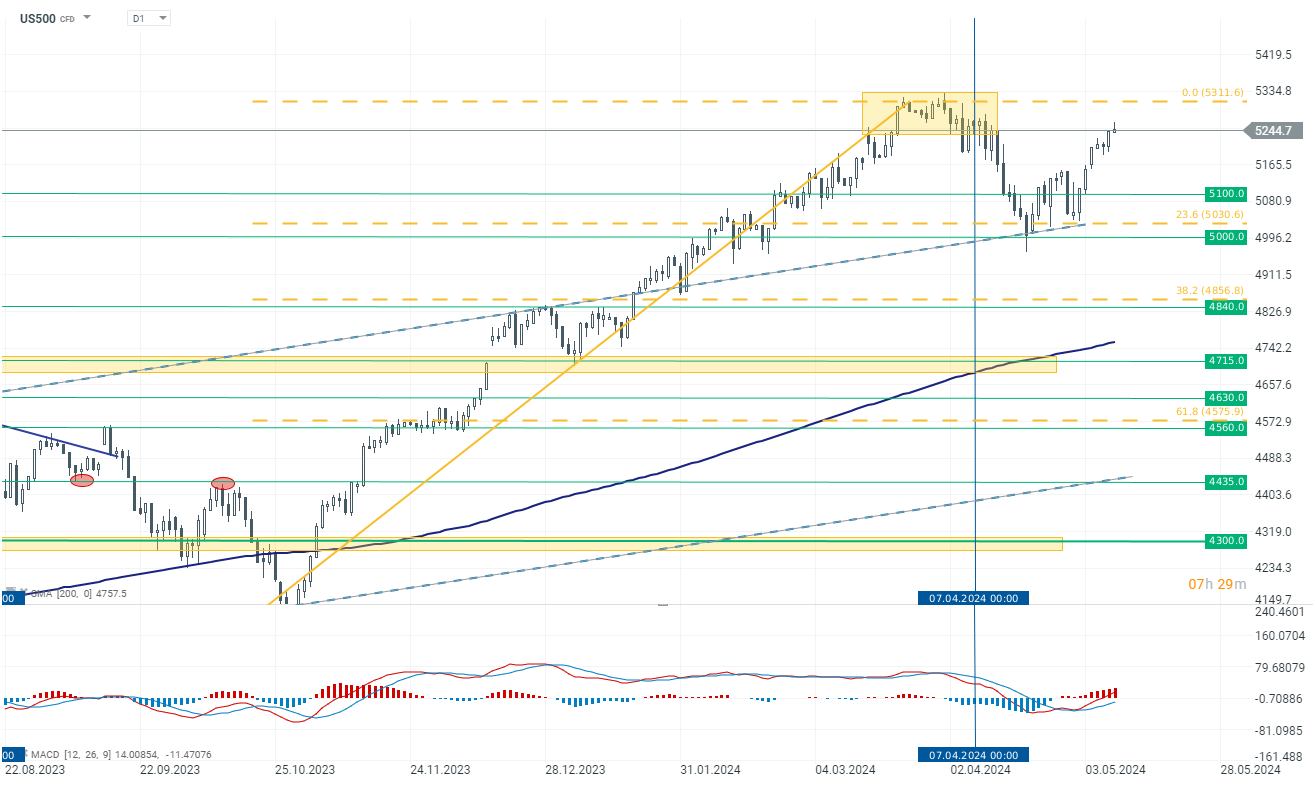

US500

Contracts on the main SP500 index are up 0.15% at the time of publication. The increases are not significant, but the levels are again close to historical highs. Bulls are currently battling the resistance zone around 5250 points.

Source: xStation 5

Company news

Novavax (NVAX.US) surged by over 120% following the deal announcement. Sanofi will acquire a 4.9% stake in the U.S. drugmaker. The taj deal and the stake acquisition values Novavax at about $1.4 billion, almost double its market capitalization of about $628 million yesterday. Additionally, Novavax will earn royalties on vaccine sales and potentially for future Sanofi vaccines that use their technology.

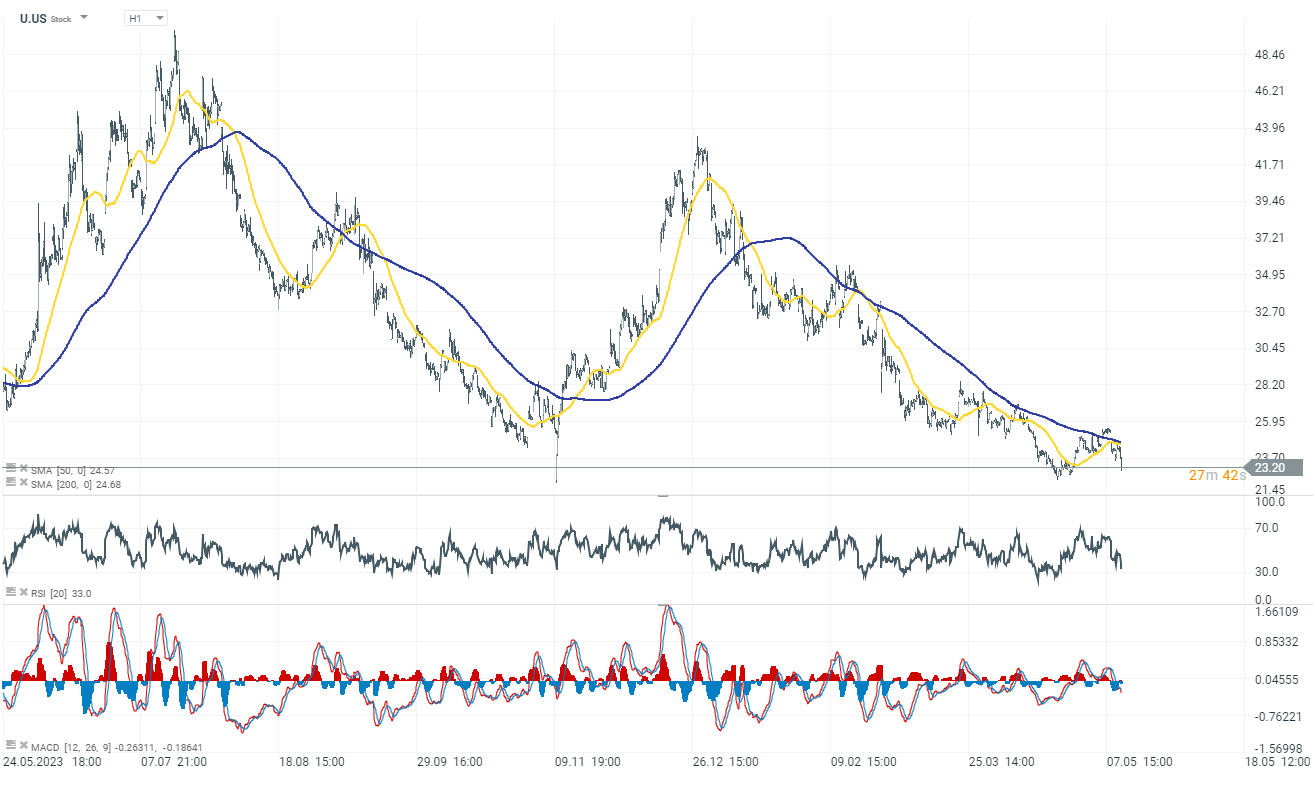

Unity Software (U.US) fell more than 5% due to mixed Q1 results and a disappointing Q2 revenue forecast. The company expects Q2 revenue between $420M and $425M, representing a 6% to 7% year-over-year decline and falling short of the consensus forecast of $443.22M. Despite the lower projections, interim CEO Jim Whitehurst emphasized the completion of a recent portfolio and cost reset, aiming to accelerate revenue growth while maintaining attractive profit and cash flow margins.

Source: xStation 5

Akamai Technologies (AKAM.US) plummeted nearly 9% after reporting mixed Q1 results and a Q2 outlook that missed market expectations. The company anticipates Q2 earnings per share between $1.51 and $1.56, below the consensus of $1.63, and sales between $967M and $986M, compared to a consensus of $1B. Akamai's board also approved a new three-year, $2 billion share buyback program.

Morning wrap (16.01.2026)

US100: Nasdaq ฟื้นตัว ขานรับคลื่นความหวังใหม่ของ AI 🤖🚀

สรุปข่าวเช้า

ข่าวเด่นวันนี้ 15 มกราคม