Futures on Nasdaq 100 (US100) 3 hours after stock market opening after yesterday holiday pause defended 20,000 points level, where we can see firs strong support zone after the rollover.

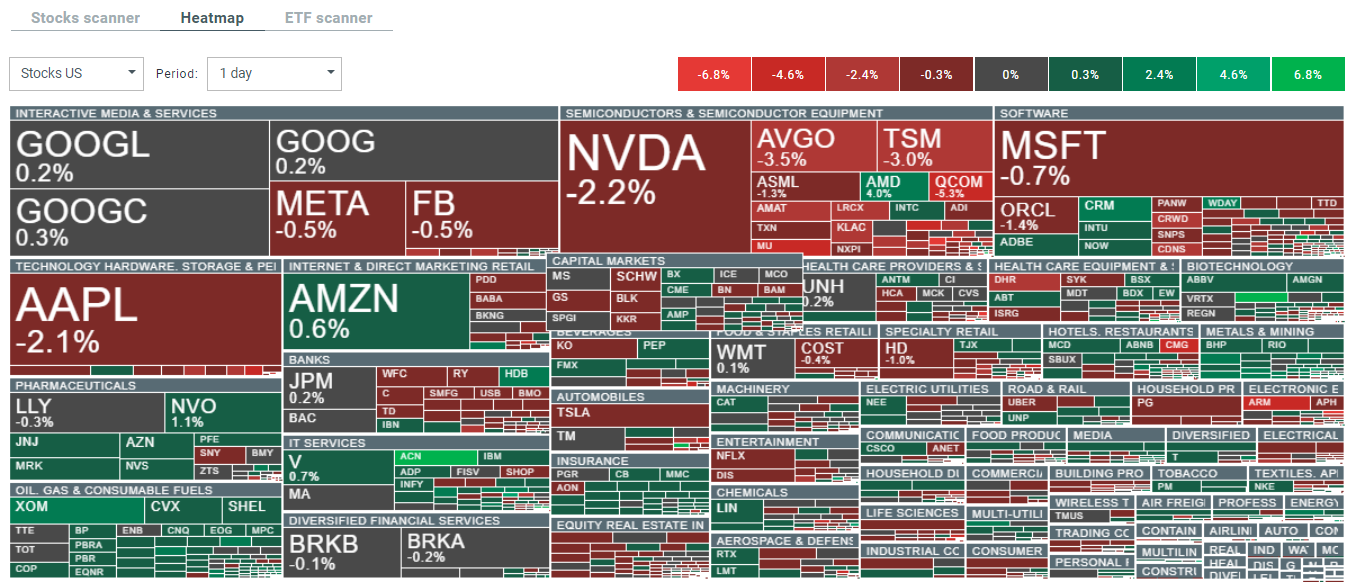

- We can see higher selling activity among AI (especially semiconductor stocks) with Nvidia (NVDA.US) erasing early almost 3% gains; now the stock of the biggest company in the world is losing more than 2%.

- Despite planning wafer price hike and higher recommendations from analysts (Bernstein) citing AI catalysts, we can see also TSMC (TSM.US) stock dropping by almost 3%. The possible reason of the decline is possibly profit realization, after US stock market reached record high.

- President Putin signing the agreement with North Korea said that 'Russia is thinking about possible changes to its nuclear doctrine' as NATO is moving to Asia, creating a security threat to the country. We can see higher selling, trading volume today on US100 contract.

US100 (M1)

Source: xStation5

Source: xStation5

What Bernstein sees for TSCM?

- Bernstein lifted price targets for TSMC’s to NT$1,080, from NT$900 (to $200 from $150 before, for US ADR-s). Now, analysts are expecting TSMC to surpass its 2024 guidance, driven by high-end phone demand and advanced technology wafers. The company's data center AI revenue is on the rise however, an unexpected boost has come from AI's influence on smartphone upgrades.

- Bernstein says that 3nm and 5nm production in company runs with full capacity and Q3 2024 revenue will beat guidance with revenues rising 25% YoY in 2024 and EPS rising 28% on yearly basis (and 26% increase in 2026, due to chipn-on-wafer-on-substrate (CoWoS) technology adoption and Intel's Lunar Lake as well as the price hikes for advanced AI chips.

- Bernstein suggested that TSMC with forward price-to-earnings (P/E) ratio of 20 times still trades with 25% discount to average forward P/E of companies from SOX semiconductors index, which is now a new 'record high' premium for TSMC 'peers' from the index - despite rapid growth in TSMC business, and earnings growth.

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡