The Russell 2000 mid-cap U.S. index (US2000) is trading down more than 1.2% sell-off today, largely compounded by declines in the regional bank sector, which came under pressure from a broader down session among U.S. banks, where JP. Morgan (JPM.US) is losing nearly 7%, following a warning about expected lower net interest income (NII) in 2025.

- Biotechnology companies are posting the strongest gains in the index, for some of which Fed rate cuts could prove salutary and lower the risk of 'capital burnout' and business suspensions.

- Additional volatility in the market is fueled by the presidential debate between Trump and Kamala Harris due to take place Tuesday night.

- Sentiment in the smaller-cap market is further weighed down by weakness in the larger indices, which, despite recent sell-offs, are not showing strength;contracts on the DJIA (US30) are losing 0.8% today.

- Fitch Ratings analysts expect the Fed's upcoming monetary easing cycle to be relatively mild and slow, by 'historical standards'

- Federal Reserve member, Michelle Bowman commented banking sector and informed that 'concerns for stress tests include volatility & transparency.'

- Shares of New York Community Bancorp (NYCB.US) are losing almost 7% today; investors expect that higher recession probability may be a trigger for sell-off in banks, vulnerable to commercial real estates risk

- US NFIB Business Optimism Index today came in 91.2 vs. 93.6 exp. after strong upbeat to 93.7 in July. The reading suggests that the rebound in July may be only temporary, while overall US small business sentiments are still under pressure despite awaited Fed policy easing.

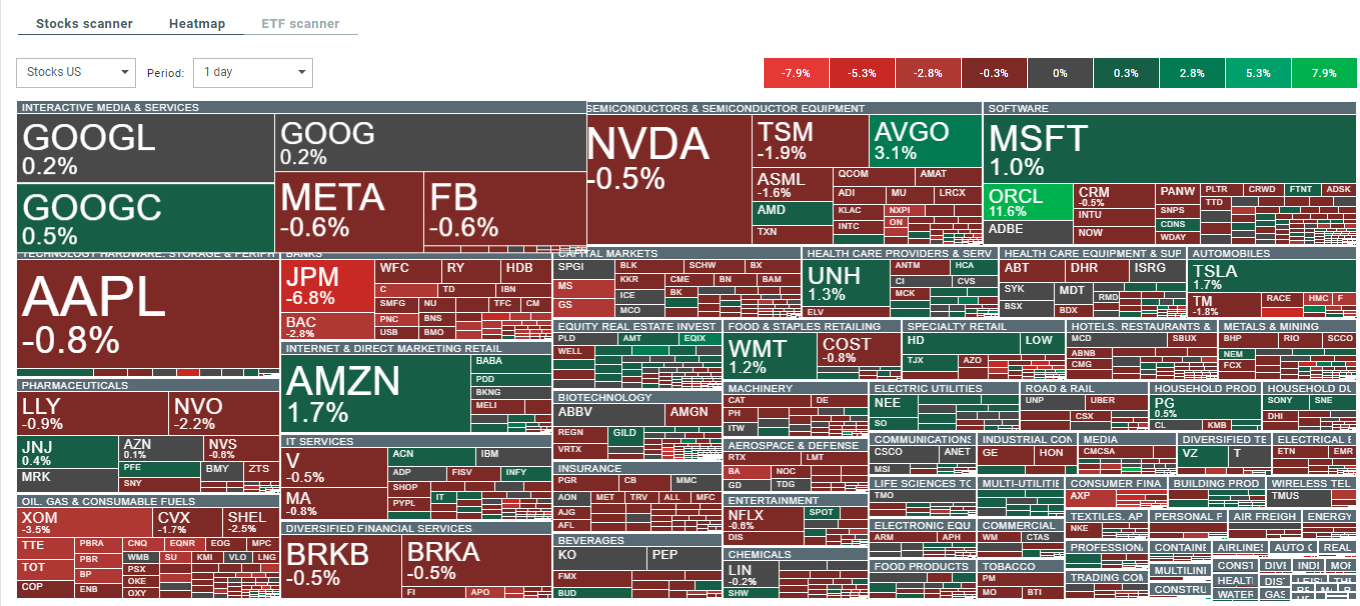

The sell-off in oil, financials, with moderate declines in the technology sector weighs on investor sentiment in the broader US market today. Source: xStation5

The sell-off in oil, financials, with moderate declines in the technology sector weighs on investor sentiment in the broader US market today. Source: xStation5

US2000 is today testing the 200-session exponential moving average (EMA200), which is the conventional boundary between a downtrend and an uptrend. Previous three attempts to go below it resulted in a decisive rebound.

Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด