After 7 PM BST we can observe increased activity from the supply side on Wall Street. However, there have been no reports in the market so far to suggest this move, so the current decline can be explained by today's inflation data from the US, where the main index came in slightly above expectations, which may support the scenario of another 25bp Fed rate hike. The Russell 2000 index, which groups small-cap companies, lost the most heavily today. On the other hand, the scale of the daily discount on the Dow Jones, S&P500 and Nasdaq 100 indexes is not large, and reaches 0.7% at the moment. Nevertheless, looking at least at the chart of the US500, there was a complete erasure of yesterday's upward move, which could have a negative impact on tomorrow's session. Closing the day below the support at 4370 points could result in a deepening of the sell-off even towards the October 4 lows

US500 defends 4380 level zone where we can see SMA100. Source: xStation5

US500 defends 4380 level zone where we can see SMA100. Source: xStation5

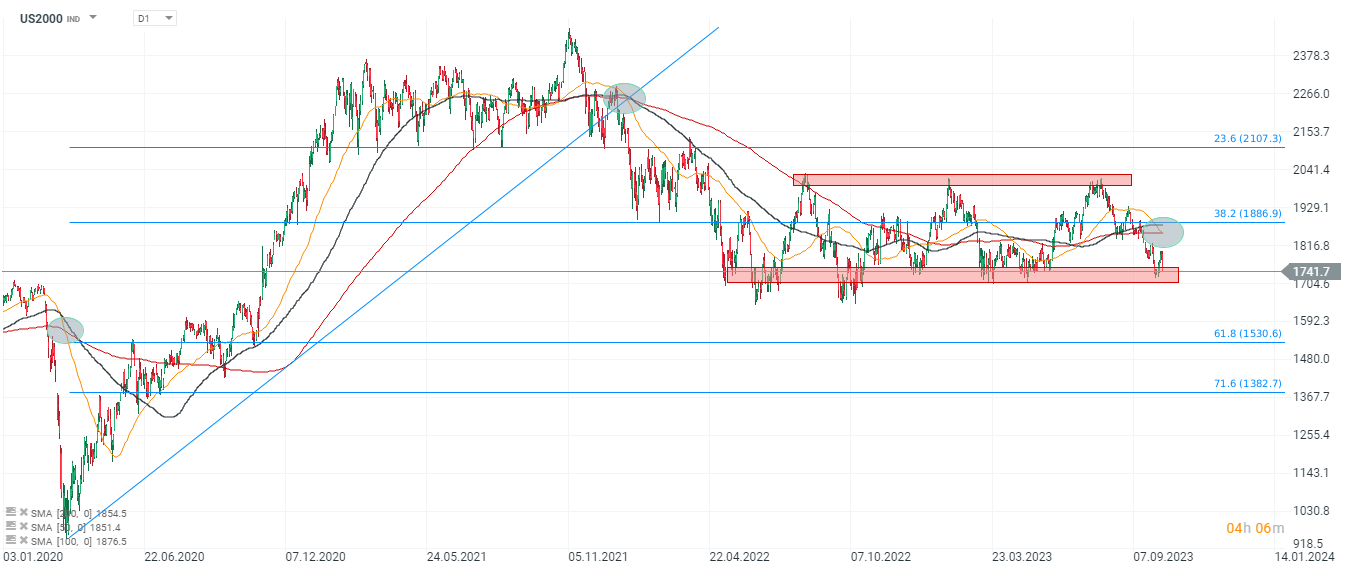

Looking at US2000 we can see that SMA200 (red line) and SMA (50) formed bearish 'death cross' formation. Source: xStation5

Looking at US2000 we can see that SMA200 (red line) and SMA (50) formed bearish 'death cross' formation. Source: xStation5

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ

Wall Street ปรับตัวขึ้นต่อเนื่อง; ดัชนี US100 รีบาวด์มากกว่า 1% 📈