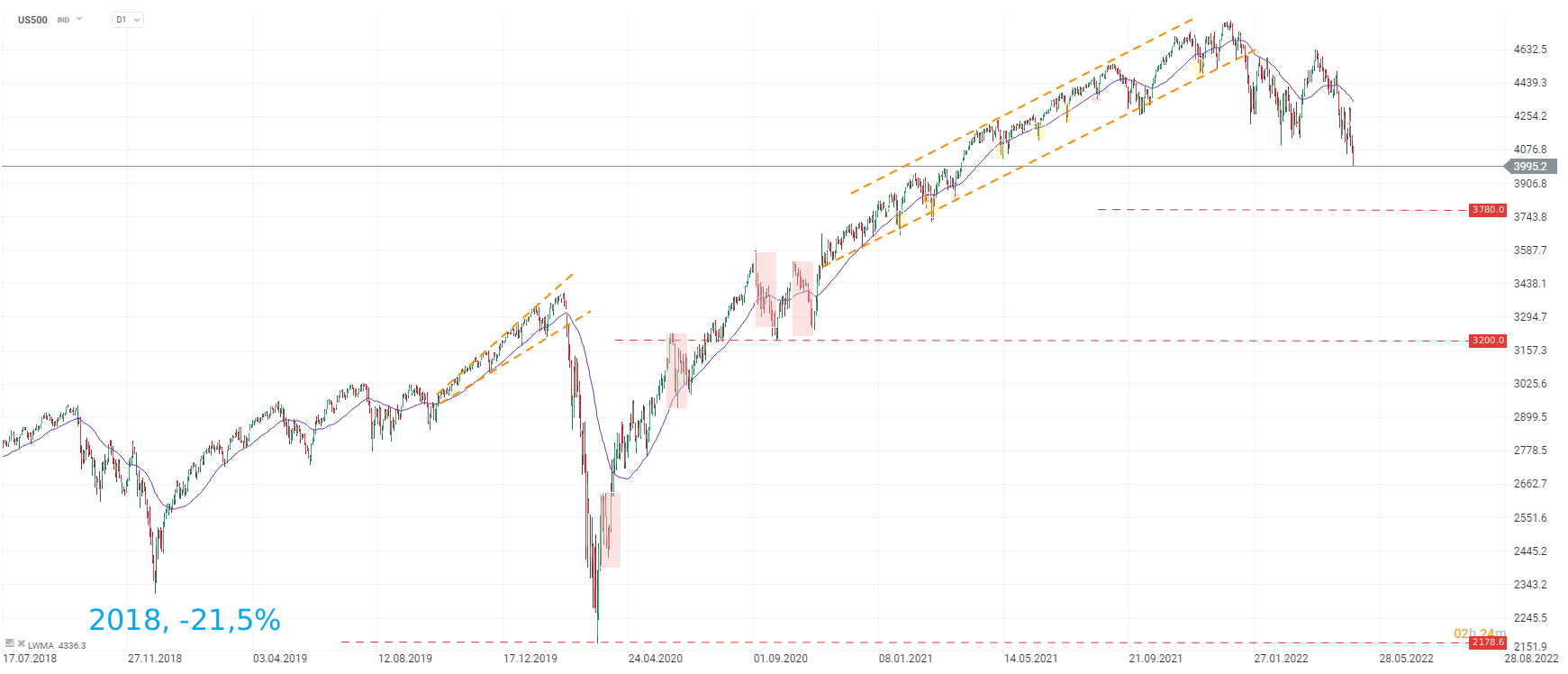

This week started in bleak moods and has not got any better as US investors failed to reverse the course for global indices. In fact, US500 is bound to decline for the third straight session and is currently below the 4000 level for the first time since 1 April 2021! While these declines look sharp, the whole move still is fairly modest compared to the post-covid rally. If the index were about to decline 21.5% from the peak as it did during the last QT episode in 2018 we would see a test of 3780 points.

Despite assurances from the Federal Reserve investors are increasingly concerned that the central bank will need to risk recession in order to tame inflation. With that in mind all eyes will be on the April US CPI release this Wednesday.

US100: จุดแข็งของการเติบโตในวอลล์สตรีท❓

US100 ร่วง 0.5% 📉 หุ้น Meta ปรับตัวลดลงต่อเนื่อง จากความกังวล ค่าใช้จ่ายด้าน AI (AI CAPEX) และคำแนะนำของ Deutsche Bank

หยวนจีน (CHN.cash) กดดัน แม้มีถ้อยคำเชิงบวกจาก Trump 🚩

วอลล์สตรีทชะลอความเชื่อมั่น หลังโอกาสลดดอกเบี้ยธ.ค.ลดลง