US retail sales report for June is a key macro release of the day. Report will be released at 1:30 pm BST and is expected to show a decline in headline retail sales. While this piece of data is not as important to Fed's decision-making as inflation or labour market data, it is a strong hint at what conditions of US consumers is.

US, retail sales for June

- Headline. Expected: -0.3% MoM. Previous: +0.1% MoM

- Ex-autos. Expected: 0.0% MoM. Previous: -0.1% MoM

- Ex-autos and fuel. Expected: 0.2% MoM. Previous: 0.1% MoM

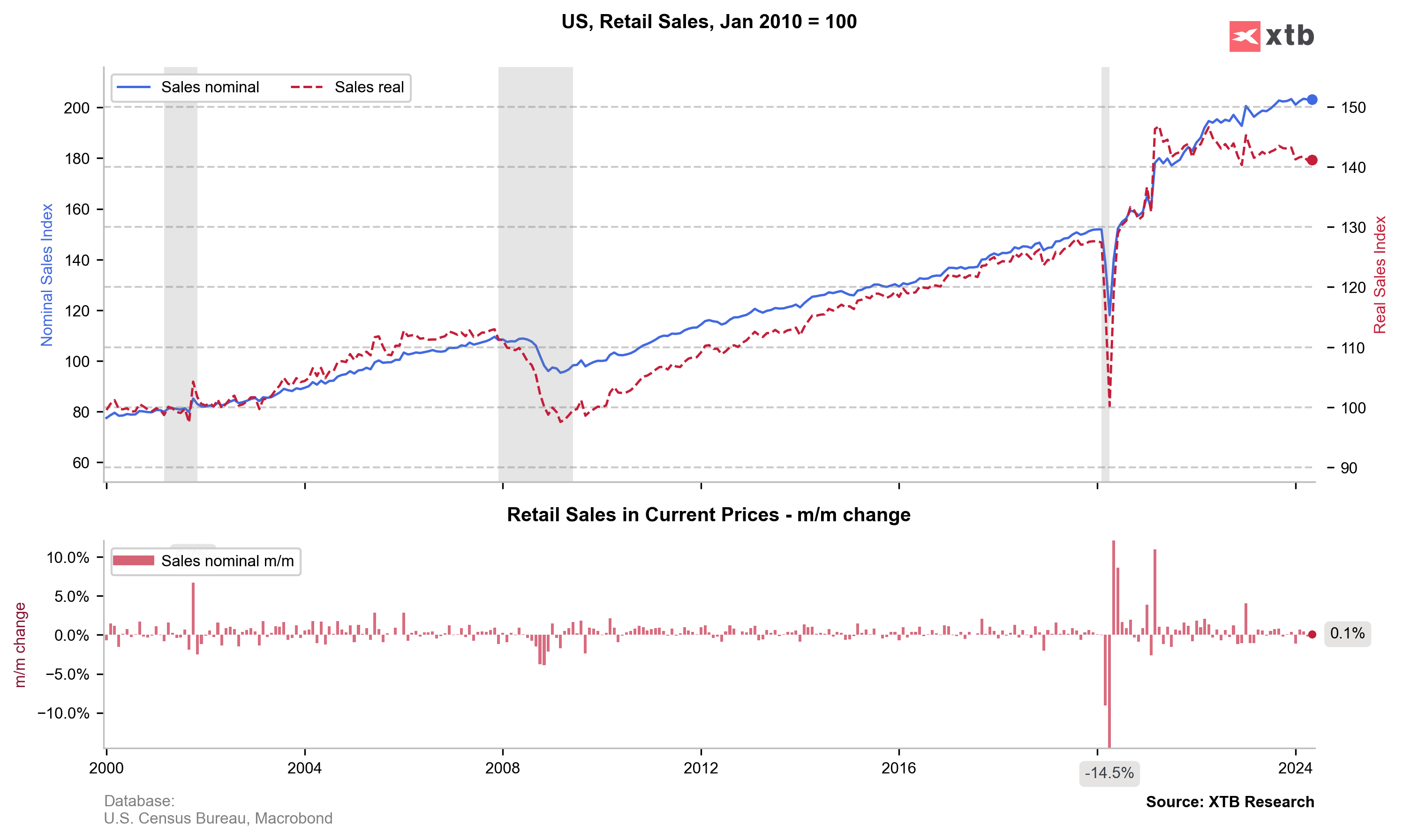

Nominal retail sales have continued to climb in recent months, a look at real retail sales data on the chart below shows that they have been pretty much stagnant for over 2 years now. However, even as nominal sales climb, growth has been sluggish compared to previous years, showing that US consumers feel the burden of a cooling labour market and high interest rates, and it discourages them from spending beyond their means.

Having said that, a disappointment in the data could see dovish Fed bets strengthen. Markets currently price in an over-100% chance of Fed delivering the first rate cut of a cycle in September. Current market pricing suggests that US central bank may deliver 2 or 3 cuts this year, and weaker retail sales data could push those odds closer to 3 cuts (September, November and December).

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Traders will also be offered a CPI inflation reading from Canada for June today at 1:30 pm BST. Canadian report is expected to show prices remaining flat compared to May (0.0% MoM), while the annual measure is expected to decelerate slightly from 2.9% to 2.8% YoY. Simultaneous release of important macro reports from US and Canada paves the way for a potentially volatile early-afternoon on USDCAD market.

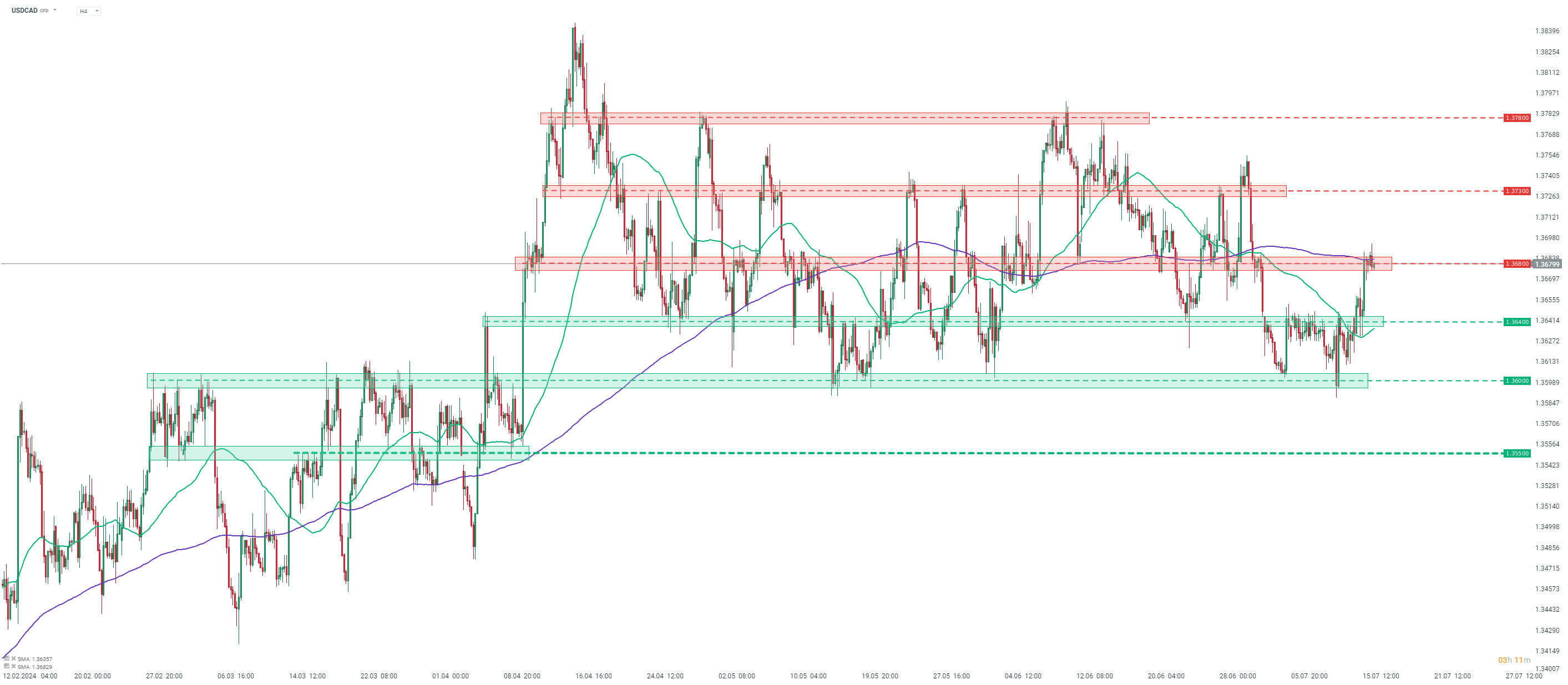

USDCAD has been trading sideways in the 1.3600-1.3780 since the second half of April 2024. The pair has recently bounced off the lower limit of the range, but bulls failed to break above the 1.3680 resistance zone. Should US retail sales data today disappoint, the pair could pullback from the area. Of course, Canadian data will also play a role in market's reaction. Higher-than-expected Canadian reading along with weak US print would be the bearish scenario for USDCAD, while weaker-than-expected Canadian CPI and strong US retail sales would be a bullish scenario. In other cases, direction of the move on USDCAD would likely be determined by whether US data beats or misses, as it is more important reading than Canadian release.

Source: xStation5

Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์