Japanese yen is in the spotlight this morning, with USDJPY dropping to the 148.00 area - the lowest level in a month. There is a number of factors in play that are supporting Japanese currency today and all of them are related to the monetary policy:

- Japanese wages data showed cash earnings growing 2.0% YoY in January (exp. 1.2% YoY) and real cash earnings declining 0.6% YoY (exp. -1.5% YoY)

- Japanese Trade Union Confederation said that its affiliated unions demand an average wage increase of 5.85% in this year's wage talks - the biggest increase in 30 years

- Bloomberg reported that several Japanese government officials support a near-term policy tightening

- BoJ Governor Ueda said that certainty for hitting inflation target is increasing gradually

- BoJ member Nakagawa said that Japanese economy is steadily making progress towards the 2% inflation target

There is a strong conviction in Japan that higher wages are needed to fuel inflation and hit the 2% target sustainably. Having said that, better-than-expected wage growth data for January as well as demand for the biggest wage increase from unions in 30 years are strong hawkish factors for JPY. Adding to that acknowledgement from BoJ Governor Ueda and BoJ member Nakagawa that economy is steadily moving towards inflation target, one should not be surprised that markets are getting increasingly hawkish. Money markets now see a 78% chance of BoJ ending negative rates at March 19 meeting, up from less than 60% yesterday.

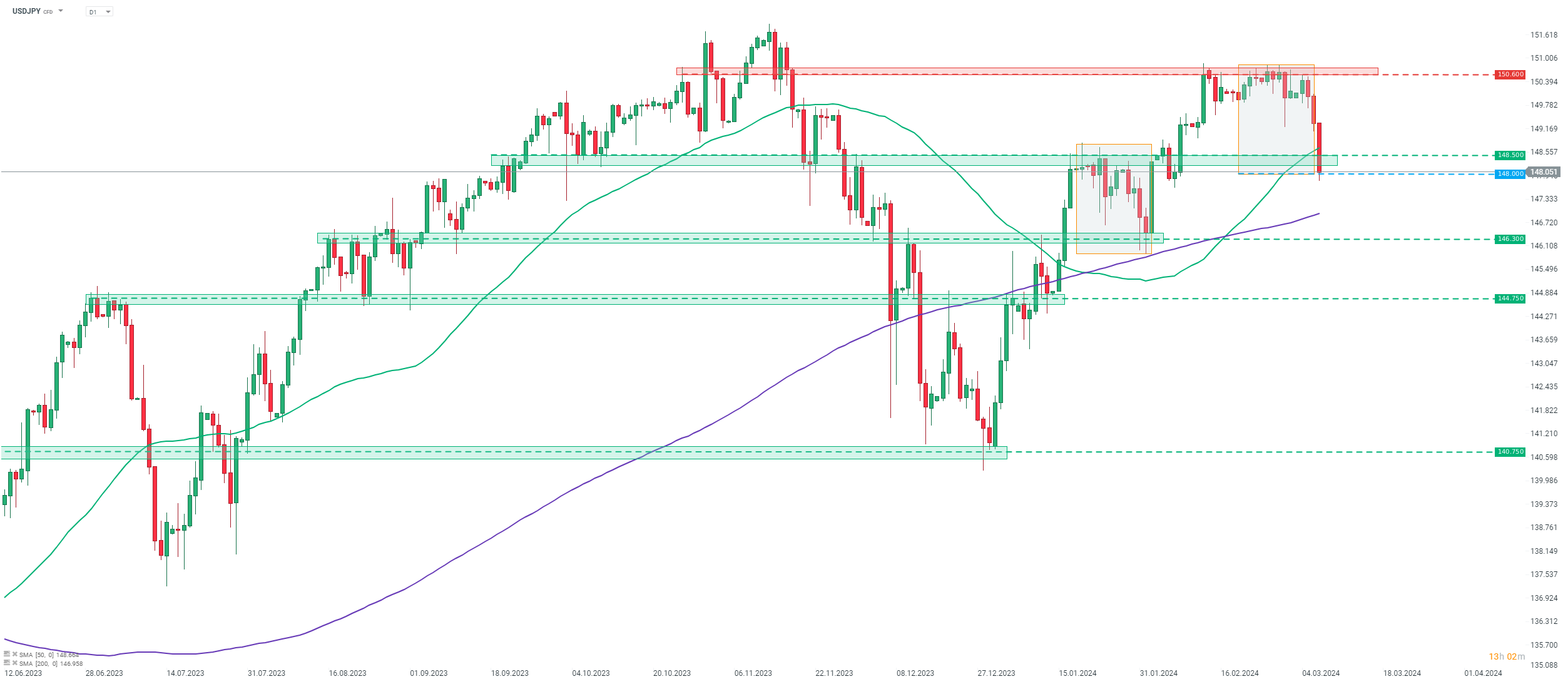

Taking a look at USDJPY chart at D1 interval, we can see that the pair dropped below 50-session moving average (green line) today for the first time since mid-January and is trading at the lowest level in a month. The pair is testing the 148.00 area, marked with the lower limit of the Overbalance structure. A break below would, in theory, hint a trend reversing to bearish. However, traders should keep in mind that it is not the first time when an imminent end to negative rates in Japan is heralded by the markets, therefore a scope for disappointment on March 19 remains.

Source: xStation5

Source: xStation5

Chart of the Day: EURUSD - ยูโร vs ดอลลาร์ ใครแรงกว่ากัน? 💱

สรุปข่าวเช้า: ความตึงเครียดความขัดแย้งดันราคาน้ำมันแตะ 100 ดอลลาร์ (12.03.2025)

🚨 EURUSD ก่อนการประกาศ CPI ของสหรัฐฯ

AUDUSD: ธนาคารกลางออสเตรเลีย (RBA) จะเป็นธนาคารกลางแห่งแรกที่กลับมาขึ้นดอกเบี้ยอีกครั้งหรือไม่? 🪙