Japan's Nikkei 225 index (JP225) is up 1.00% today, and the total rebound from last week's low has already reached 20%. On the other hand, the index remains almost 16% below the highs set on July 11, 2024.

The incredible volatility in the Japanese market is the result of the Bank of Japan's recent interest rate hike and investor panic related to the sharp appreciation of the JPY and "carry trade." Today, in the first part of the day, we received a series of new data for Japan, which are quite positive:

00:50 AM BST, Japan - GDP data:

- GDP (Q2): actual 3.1% y/y; forecast 2.1% y/y; previous -2.3% y/y;

- GDP (q/q) (Q2): actual 0.8%; forecast 0.6%; previous -0.6%;

- Private consumption's contribution to GDP (q/q) (Q2): actual 1.0%; forecast 0.5%; previous -0.6%;

- GDP deflator (Q2): actual 3.0% y/y; forecast 2.6% y/y; previous 3.4% y/y;

05:30 AM BST, Japan - industrial production for June:

- Industrial production: actual -4.2% m/m; forecast -3.6% m/m; previous 3.6% m/m.

Japan's economy grew much faster than expected in the second quarter (3.1% annually), rebounding after a slump at the beginning of the year due to strong consumption growth. The data is positive, with signs of a recovery in private consumption supported by an increase in real wages.

Will the BoJ hold off on further hikes?

The incoming data from Japan's economy seems to confirm the BoJ's expectations. As a result, it is possible that the Bank of Japan may decide on another interest rate hike later this year. However, the likelihood of another rate cut at the September and October meetings has significantly decreased after Prime Minister Kishida announced that he would not seek re-election and would step down next month.

The main reason for this decision is public dissatisfaction with rising living costs. For this reason, it is unlikely that the central bank will opt for an additional rate hike during this period and will be more inclined to wait until the situation in the country stabilizes, and macroeconomic data fully reflect the effects of recent rate hikes.

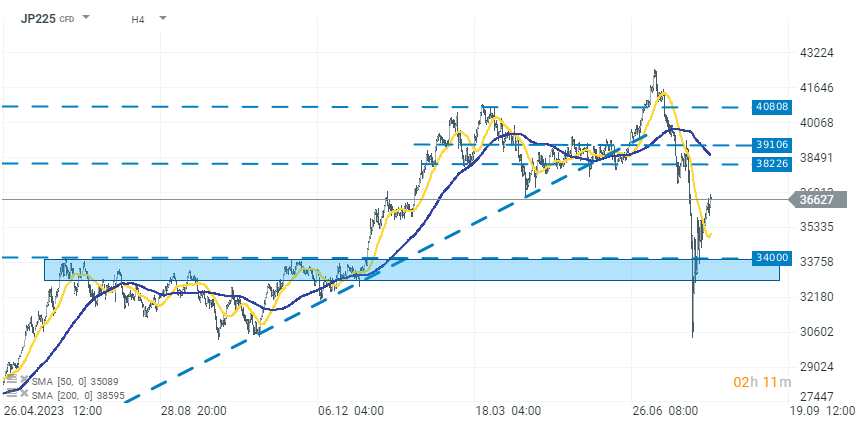

JP225 (D1 interval)

Japan's Nikkei 225 index (JP225) is up 1.00% today, adding to this week's dynamic rebound. The recent investor panic pushed the index down to around 30,000 points, the lowest level since mid-2023. This area already served as significant support in October and November 2023. This time, the declines were also halted there. The dynamic rebound above 36,000 points and good macro data give hope to the bulls for gains even around 38,000 points in the short term. Otherwise, the 34,000-point level, which is the nearest support zone, should be kept in mind.

Source: xStation 5

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

ตลาดเด่นวันนี้: EURUSD

US500 ปรับขึ้น หลังเจ้าหน้าที่ทหารส่งสัญญาณบวกต่อสถานการณ์ในช่องแคบฮอร์มุซ

สรุปข่าวเช้า 5 มี.ค.